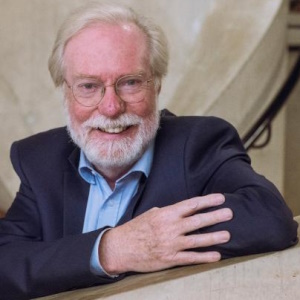

Economist and Financial Guru, Finance Professor

and Founder of Burkenroad Reports

Two-time winner of the Tulane University Freeman School of Business top Professor award, Peter Richutti combines penetrating insight into the financial markets with a fine sense of humor which makes his speeches invaluable.

Economist

Peter cut his teeth working for the investment firm of Kidder Peabody and went on, as the assistant treasurer for the state of Louisiana, to manage funds of over $3 billion. He is the founder of Tulane’s renowned Burkenroad Reports stock research program.

Guru

In great demand as a public speaker for over two decades, Peter has addressed hundreds of groups in virtually every state in the country as well as overseas. Among these more exotic audiences were the New Orleans Saints. His work has been featured on CNN and CNBC, and also in the New York Times, Barron′s, Washington Post and Wall Street Journal.

Professor

Peter Ricchiuti (Ri-Shooty) is the business school professor you wish you had back in college! He teaches courses on the financial markets at Tulane University’s Freeman School of Business. His insight and humor have twice made him the school’s top professor.

Burkenroad Reports

Peter started his career with the investment firm of Kidder Peabody and later managed over three billion dollars as the assistant treasurer for the state of Louisiana. In 1993 he founded Tulane’s highly acclaimed BURKENROAD REPORTS stock research program.

Speaker

Over the past twenty years Peter has addressed hundreds of groups in 47 states and several countries. He has presented to a wide variety of audiences including workshops for the New Orleans Saints.

MARKET SIGNALS: What The Financial Markets Are Telling Us Now??

The economy is inherently cyclical. While these cycles don’t necessarily repeat themselves, they usually rhyme. “The financial markets often foretell what’s ahead for the economy. This can illuminate opportunities and serve as valuable storm warnings for business leaders. A lot of this runs counter to what people are commonly hearing in the media.

Uncertainty Brings Opportunity

The decisions made by business leaders and investors during tough times determine their relative condition when things improve. Decision makers need the proper tools to correctly balance survival and opportunism. Making the right calls involves blocking out the noise and remembering that if a majority of the people were right, … a majority of the people would be rich.

The Four Most Dangerous Words In Finance - “THIS TIME IT’S DIFFERENT!”

Trees don’t really grow to the sky and downturns eventually find some kind of equilibrium point. In times of great optimism and great pessimism we tend to lose sight of historical economic patterns and valuations. Unfortunately, for many each time is the first time. The buzzing background of the 24 hour news cycle only serves to make this worse. We will look at indicators that deliver perspective.

Do These Earnings Make My PE Look Big?

How high is too high? The truth is that no investment is either good or bad. It is all a function of the price that you are buying or selling it at. This kind of thinking is often ignored in a market frenzy. It’s often tough to trust your instincts, focus on the historic patterns and not get swept up by all those talking heads. As economist John Kenneth Galbraith once said “there are two kinds of forecasters, those that don’t know, and those that don’t know that they don’t know.”

All Peter Ricchiuti Books